Stakeholder Engagement & Double Materiality Assessment

Engaging with Our Stakeholders

We prioritise regular and meaningful communication with our key stakeholders to understand their perspectives and expectations on sustainability. By leveraging diverse communication channels, we foster collaboration and align our sustainability initiatives with the priorities of our stakeholders. The table below summarises our engagement modes for key stakeholder groups, including colleagues, customers, suppliers, industry associations, non-governmental organisations, and industry experts.

- Chinachem Group Sustainability Conference

- Stakeholder engagement exercises

- Training sessions

- Mall events and promotions

- Organisational memberships

- Community Service and Volunteering Activities

- Company Recreational Activities and Events

- Government Campaign Signatories

- Collaboration with local university for training and research projects

- Media gatherings

- Corporate donations

Activities & Events

- Townhall meetings

- Leadership presentations

- Committee and Working Group meetings

- Consultative groups

- Project partnerships

Forums & Meetings

- Employee surveys

- Customer satisfaction surveys

- Property owner satisfaction surveys

- Property services satisfaction surveys

Surveys

- Chinachem Sustainable Finance Framework

- Sustainability Report

- Press releases

- Intranet and Viva Engage

- Company website and owned social media

- e-Learning platforms

- Life+ Magazine

- Environmental message cards

- Face-to-face engagements

- Loyalty membership programme

- Mobile Applications

Publications & Communication Channels

Assessing Materiality

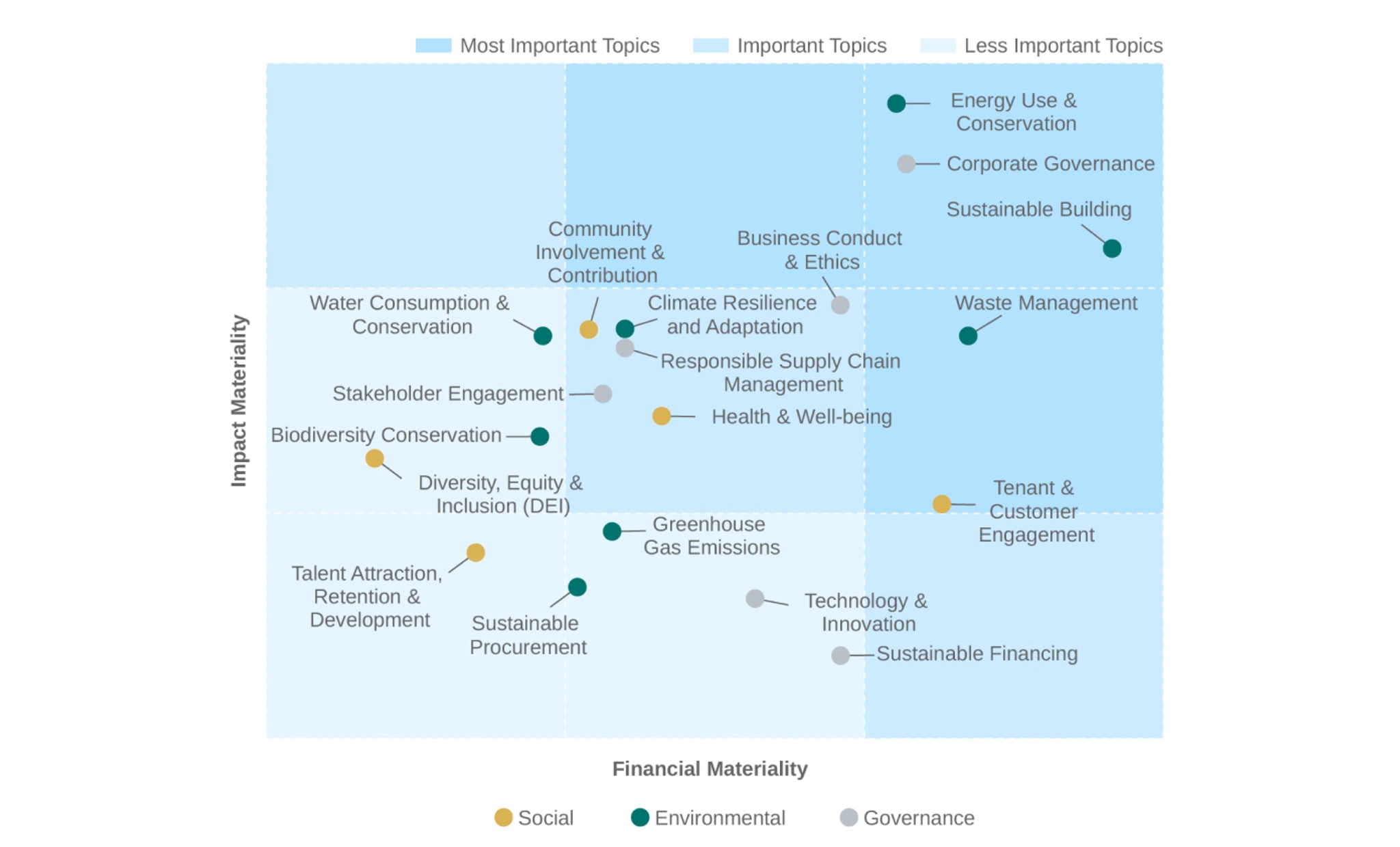

In 2024, CCG deployed a double materiality assessment approach to evaluate the impact and financial materiality of key ESG topics. Stakeholder-driven insights enabled us to prioritise the management of material ESG issues, guiding strategic decision-making. During the Reporting Period, we reviewed and confirmed that the results of the materiality assessment remain relevant, reflecting sustainability and climate-related risks and opportunities based on the Group’s development, industry trends, stakeholder expectations, and sustainability trends. Through stringent review of assessment results, we reshaped the strategic focus of our ESG Sub-Committees for FY25/26. In response to the expectations of our stakeholders and the material topics identified, we have established specific KPIs and targets to steer our long-term sustainability roadmap.

We have reviewed these strategic topics and validated their relevance in terms of both impact and financial materiality for the Group. The Group analysed both quantitative and qualitative findings from the surveys, interviews and focus group sessions to derive our assessment result.

This assessment has taken into consideration the interdependence between financial materiality and impact materiality dimensions:

|

Financial Materiality (Inward Impact) |

Related to financial risks and opportunities for CCG |

Engaged key external stakeholders, including banks, financial institutions, and rating agencies, along with internal stakeholders, including senior management and finance teams. Stakeholders were selected based on financial expertise, industry experience, and influence on financial decision-making. |

|

Impact Materiality (Outward Impact) |

Related to actual or potential positive or negative impact on people or the environment for CCG |

Engaged a broad range of internal and external stakeholders. Stakeholders were selected based on relevant ESG knowledge and expertise. They have high level involvement in CCG with strong representation. |

Related to financial risks and opportunities for CCG

Engaged key external stakeholders, including banks, financial institutions, and rating agencies, along with internal stakeholders, including senior management and finance teams. Stakeholders were selected based on financial expertise, industry experience, and influence on financial decision-making.

Related to actual or potential positive or negative impact on people or the environment for CCG

Engaged a broad range of internal and external stakeholders. Stakeholders were selected based on relevant ESG knowledge and expertise. They have high level involvement in CCG with strong representation.

Materiality Assessment:

Identify 19 ESG issues, benchmarking against industry peers and aligning with disclosure standards

Capture stakeholders’ insights & opinion through:

- Online surveys

- Two focus group discussion and interview sessions with internal stakeholders

Double Materiality Matrix

The assessment result was aligned and linked with material impacts, risks, and opportunites (“IROs”):

- Opportunities to reduce operating costs due to the reduction in energy consumption

- Build up reputation regarding the compliance with energy efficiency standards and efforts made in low-carbon economy transition

- Attract environmentally conscious tenants

- Minimise our environmental impact and conserve resources

Management of IROs

- Establish our CCG 3050+ plan, with a dedicated Working Group to drive environmental management initiatives for CCG

- Commit to reducing operational carbon intensity in Scope 1 and 2 by 51.8% by 2030

- Explore and adopt innovation and renewable energy solutions across our new and existing projects

- Plan a range of decarbonisation projects, such as replacement of chillers, heat pumps and other critical infrastructure upgrades, to enhance efficiency of our building portfolio

Reference Section

Accelerating Our Green TransformationEnergy Use & Conservation

- Increase customer retention

- Advance the development of green tenancy to promote green practices and initiatives

- Deliver quality products and services by addressing stakeholders’ needs and concerns

Management of IROs

- Launch a loyalty programme of CCG hearts and a mobile application of “My Places by Chinachem Group”

- Conduct regular tenant and customer engagement

- Implement rigorous quality assurance protocols to maintain excellence in our products and services

Reference Section

Promoting Sustainability to Our Stakeholders through Collaboration Ensuring Customer & Tenant Satisfaction through Service ExcellenceTenant & Customer Engagement

- Pursuit of green building certifications presents opportunities for property value appreciation and market appeal for increasing return on investment

- Mitigate compliance risks and save regulatory cost

- Minimise environmental footprint and save operating cost through deploying sustainable building features and technologies

- Improve wellbeing of our residents

Management of IROs

- Adopt sustainable designs and systems in our new and major A&A projects, including passive building designs, natural ventilation, BIM, MiC, smart IoT systems, and MiMEP

- Set commitment to green building as driven by Sustainable Design and Procurement Manual

- Commit to achieving at least the 2nd-highest rating of sustainability certification for all newly development projects

Reference Section

Demonstrating Green Building LeadershipSustainable Buildings

- Prepare for stricter regulations on waste management

- Safeguard public health and promote a cleaner environment through waste reduction

Management of IROs

- Introduce waste management protocol and solutions for our business segments

- Implement joint waste management initiatives in collaboration with tenants

Reference Section

Accelerating Our Green TransformationWaste Management

- Promote sustainable growth for both the Group and the stakeholders it serves

- Reduce potential economic loss from identified risks

- Improve financial impact and increase long-term profitability by identifying opportunities

Management of IROs

- Secure the highest corporate governance standard

- Set up dedicated ESG governance structure to oversee sustainability matters for strategic decision-making

- Identify, assess, and mitigate a wide range of sustainability- and climate-related risks and opportunities

Reference Section

Building Our High Standards of ESG GovernanceCorporate Governance

Following the review and endorsement by the Board and senior management, the priority material topics and IROs have been integrated into our strategic planning and decision-making processes. The results from stakeholder engagement and the double materiality assessment serve as a foundation for identifying action items and KPIs in FY2024/25, ensuring that we align with stakeholder expectations and sustainability goals.

The annual Chinachem Group Sustainability Conference serves as our flagship stakeholder engagement programme, bringing together local and international thought leaders in a forum where ideas are shared, solutions explored, and meaningful change is driven for pressing and emerging sustainability issues.

Case Study

Chinachem Group Sustainability Conference 2024

The Chinachem Group Sustainability Conference 2024, co-organised by BEC and HKGBC, adopted the theme, “Integrating Sustainability Solutions Towards a Resilient Future”. Showcasing our unwavering commitment to supporting Hong Kong and the industry in pursuing a sustainability journey, the CCG Sustainability Conference attracted over 5,000 participants, contributing to a sustainable future for Hong Kong.

The conference brought together 12 advisory panel members and 52 guest speakers to lead 13 thought-provoking sessions. These sessions explored interconnected solutions across three pivotal topics: climate change, sustainable financing, and impact investment. Additionally, CCG organised guided tours of its flagship CSR project, Nina Park, providing practical insights into how CCG integrates sustainability, particularly green building and biodiversity considerations, into its properties.

Drawing on the insights gained from the conference, CCG, BEC and HKGBC initiated joint submissions to the Council for Carbon Neutrality and Sustainable Development (“CCNSD”). The submissions proposed actionable recommendations for the CCNSD’s strategic planning and policy development, emphasising the significance of innovation, the evolving role of sustainable finance, and the multifaceted strategies for climate resilience, fostering interdisciplinary collaboration among stakeholders. The recommendations focused on two key areas:

Climate Change

Recommendations centred on enhancing climate resilience through:

- Developing integrated action plans to expand the scope of the Climate Action Plan 2050

- Centralising climate data to improve decision-making

- Prioritising investments in research, development, and innovation

- Integrating climate change considerations into public health planning

- Fostering strategic partnerships and community engagement

Sustainable Financing & Impact Investment

Recommendations aimed to strengthen sustainable financing and impact investment by:

- Enhancing sectoral support and guidance for financial institutions

- Expanding the Hong Kong taxonomy to channel funds to priority sustainability sectors

- Prioritising sustainable urban planning and channeling sustainable finance to build climate resilience

- Promoting public-private partnerships and strategic collaborations

- Improving accessibility to impact investment and focusing on raising public awareness