Climate Resilience

We recognise the importance of identifying and managing the possible risks and opportunities that climate change may present to our operations for assessing climate resilience. Our disclosures reference the recommendations of IFRS S2, covering the four essential pillars: governance, strategy, risk management, and metrics and targets.

Governance on Climate-related Issues

The Board assumes overall responsibilities to oversee climate-related matters, such as tracking the progress of CCG 3050+. The ESG Steering Committee, chaired by the Chief Executive Officer (the “CEO”), oversees the Group’s overall ESG strategies, reviews and endorses plans and monitors progress. Additionally, the ESG Sub-Committee Environment, in its management role, focuses on integrating climate-related considerations into strategic decision-making and daily operations. The ESG Department leads Group- wide initiatives and collaborates with business units to assess and monitor climate-related risks and opportunities, supporting strategic planning and enhancing the sustainability of building lifecycles. Demonstrating the leadership team’s commitment to sustainable development and the advancement of sustainability expertise, senior executives participated in the Chinachem Group Sustainability Conference 2024 to gain insights into the latest industry trends and developments.

For more detailed information on our ESG governance structure, please refer to the “Setting High Standards of ESG Governance” section.

Strategy on Climate-related Issues

We recognise that climate change has significant impacts, and we are committed to addressing climate-related issues effectively through climate-resilient strategies and policies. CCG requires its businesses, activities, supplies, products, and services to be strictly regulated under the Climate Change Policy, integrating climate change consideration into the decision-making process for climate mitigation and adaptation.

The CCG 3050+ roadmap, which aligns with the 1.5˚C pathway and has been approved by SBTi, guides our efforts in:

- Transitioning to a low-carbon economy

- Achieving significant carbon reductions across our operations and value chain

To support the roadmap, we have implemented various decarbonisation initiatives across the Group and developed plans to further drive our decarbonisation journey in the future. Initiatives such as energy efficiency measures, adoption of renewable energy, development of green buildings, and tenant engagement programmes are already underway. Looking ahead, we have planned a range of decarbonisation projects, resulting in approximately 86,000 MWh of energy saving till 2030, equivalent to the annual emissions of around 4,700 standard households in Hong Kong.

Embracing sustainability concepts in the project design and construction process is a critical step in the real estate sector. The Sustainable Design and Procurement Manual outlines both mandatory and optional sustainability elements to be incorporated throughout the design and operational phases. Our climate strategy further extends to project financing through green financial instruments. These funds support eligible green and social projects that deliver meaningful environmental and social benefits to communities, all of which are governed by the Chinachem Group Sustainable Finance Framework (“CCG SF Framework”).

The Group materialises the collaboration efforts across our properties, operations, employees and supply chain to address both physical and transition risks related to climate change. With three time horizons defined, namely short-term (2030), mid-term (2050), and long-term (2100), it facilitates us implementing mitigation strategies and responses echoing the identified climate-related risks and opportunities, ranging from short-term to long-term. These measures aim to minimise potential losses, accelerate our transition to a low-carbon economy, and strengthen our capacity to adapt to evolving climate risks.

Define three time horizons by CCG:

- Short-term (2030)

- Mid-term (2050)

- Long-term (2100)

Scenario Analysis

In response to identified climate-related risks, the Group has conducted a scenario analysis that focuses on both physical and transition risks. Developing scenarios helps understanding climate exposure to project future changes in relevant variables.

For physical risks scenario analysis, downscaled climate change projections were sourced from the Intergovernmental Panel on Climate Change (“IPCC”), National Aeronautics and Space Administration (“NASA”), the Hong Kong Observatory, and academic research.

Climate Projections of Physical Risks Scenario Analysis

|

Climate Scenario |

Description |

Global Surface Temperature Increase (by 2100) |

|

SSP1-2.6/ Low-Emissions |

A low-emissions, sustainable future is aligned with the Paris Agreement |

1.8˚C |

|

SSP2-4.5/ Moderate-Emissions |

Moderate emissions, climate policies, and a balanced view |

2.7˚C |

|

SSP5-8.5/ High-Emissions |

High-emissions, fossil fuel-intensive, and limited climate policies |

4.4˚C |

Climate Scenario

Description

A low-emissions, sustainable future is aligned with the Paris Agreement

Global Surface Temperature Increase (by 2100)

1.8˚C

Description

Moderate emissions, climate policies, and a balanced view

Global Surface Temperature Increase (by 2100)

2.7˚C

Description

High-emissions, fossil fuel-intensive, and limited climate policies

Global Surface Temperature Increase (by 2100)

4.4˚C

For transition risk scenario analysis, downscaled projections of the climate system, economy, and energy sector were obtained from the Network for Greening Financial Services (“NGFS”) and the International Institute for Applied Systems Analysis (“IIASA”). The Group has referenced two highly contrasting transition scenarios to enable planning for both best- and worst-case outcomes.

Climate Projections of Transition Risks Scenario Analysis

|

Climate Scenario |

Description |

|

Current Policies (3˚C + of warming) |

This scenario assumes that only currently implemented policies are preserved. Emissions continue to grow until 2080, leading to approximately 3˚C of warming. Slow developments in low-carbon technology or market changes are expected. |

|

Net Zero 2050 (1.5˚C of warming) |

This scenario assumes that ambitious climate policies are introduced immediately. Net CO² emissions reach zero around 2050, giving at least a 50% chance of limiting global warming to below 1.5˚C by the end of the century. Rapid developments in low-carbon innovation and technology, including carbon removal, are expected. |

Climate Scenario

Description

This scenario assumes that only currently implemented policies are preserved. Emissions continue to grow until 2080, leading to approximately 3˚C of warming. Slow developments in low-carbon technology or market changes are expected.

Description

This scenario assumes that ambitious climate policies are introduced immediately. Net CO² emissions reach zero around 2050, giving at least a 50% chance of limiting global warming to below 1.5˚C by the end of the century. Rapid developments in low-carbon innovation and technology, including carbon removal, are expected.

Physical Risks Assessment, with Impacts & Responses

|

Risk Type |

Physical Risks Drivers |

Potential Impacts |

Risk Mitigation |

|

Chronic |

Drought Stress |

|

|

|

Heat Stress |

|

|

|

|

Acute |

Wildfire |

|

|

|

Hurricanes & Typhoons |

|

|

|

|

Surface Water Flood & Coastal Flood |

|

|

|

|

Landslide |

|

|

Risk Type

Physical Risks Drivers

Drought Stress

Potential Impacts

- Higher operating costs due to increased water consumption

- Reduce access to portable water

- Increase insurance premiums

Risk Mitigation

- Inspect systems regularly to fix leaks

- Upgrade to water-saving fixtures and adopt a water recycling system

Physical Risks Drivers

Heat Stress

Potential Impacts

- Increase in operational cost due to higher energy consumption for cooling

- Increase costs due to delays in development projects

Risk Mitigation

- Conduct energy audits

- Upgrade insulations, façades, and windows to reduce solar heat intake

- Maintain and replace HVAC systems with energy-efficient models and advanced features

- Monitor weather warnings and use shading devices to reduce solar heat gain and cooling loads

Physical Risks Drivers

Wildfire

Potential Impacts

- Damage to building infrastructure and higher repair costs

- Property loss and safety hazards

- Increase costs due to delays in development projects

Risk Mitigation

- Install barriers to slow down fire spread

- Designate multiple evacuation routes for safe exits during emergencies

Physical Risks Drivers

Hurricanes & Typhoons

Potential Impacts

- Significant building damage and loss

- Increased risk of ignition and explosion

- Increase costs due to delays in development projects

Risk Mitigation

- Conduct regular inspections to identify structural wear or instability

- Secure outdoor and rooftop equipment with stable bases and anchor bolts

- Inspect, repair, and upgrade to impact-resistant windows and doors

- Train staff on emergency protocols for hurricanes and typhoons

Physical Risks Drivers

Surface Water Flood & Coastal Flood

Potential Impacts

- Damage to building infrastructure and higher repair costs

- Increase costs due to delays in development projects

- Decrease in revenue due to business interruptions, such as access routes affected by floods

- Increase insurance premiums

Risk Mitigation

- Install flood barriers at main entrances and sump pumps to manage water during floods

- Regularly clear drains, gutters, and downspouts to prevent blockages

- Enhance emergency plans and evacuation routes, train staff on flood prevention protocols, and monitor weather warnings

Physical Risks Drivers

Landslide

Potential Impacts

- Damage to building infrastructure and higher repair costs

- Increase costs due to delays in development projects

- Decrease in revenue due to business interruptions, such as access routes affected by floods

- Increase insurance premiums

Risk Mitigation

- Inspect slopes and vegetation regularly, and plant deep-rooted vegetation to prevent erosion and enhance stability

- Monitor landslip warnings and designate multiple evacuation routes for safety

To understand the potential impacts of increased physical risks for our portfolio, we have mapped projected changes in climate variables to a selection of 42 representative buildings and five new construction project sites. Based on this, we have evaluated the overall risks of each property through a risk rating that considers its exposure and vulnerability to specific climate hazards, including drought stress, heat stress, hurricanes and typhoons, wildfire risk, surface water flooding, coastal flooding, and landslides.

The following charts illustrate the proportion of portfolio with physical risk exposure and vulnerability under different scenarios. Due to data rounding, some bar percentages may not add up to 100%.

Adaptation & Mitigation Efforts

Following our evaluation of exposures and vulnerabilities to physical risks, we have implemented climate resilience design in our projects.

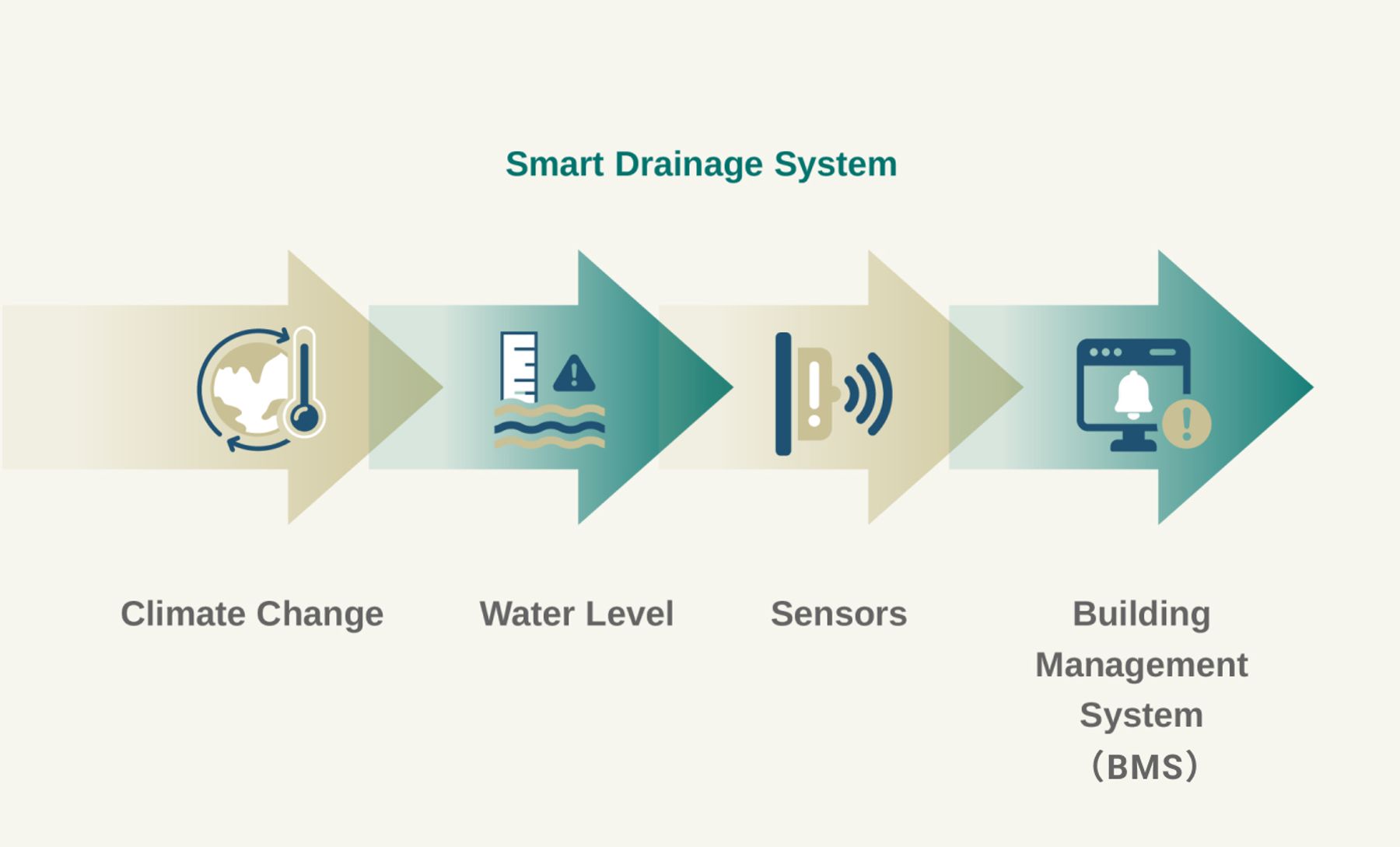

To enhance climate resilience, we consider deep pile foundations to improve building stability on the sloped site. Besides, a smart drainage system will be implemented for stormwater and foul water manholes to prevent overflow and water damage.

CCG assesses both existing buildings and new construction sites against the identified acute and chronic physical climate risks. This investigation provides insight into the current status of incorporating climate-resilient design elements across all projects. The structured evaluation serves as a practical tool to consolidate project-specific details and assess future needs for implementing necessary retrofits or adaptive measures.

Financial Impact Assessment of Physical Risks

Additionally, we have assessed the financial impacts associated with identified physical risks to evaluate their influence on our business operations, strategies, and overall economic performance. A comprehensive Value at Risk (“VaR”) assessment was conducted to quantify the potential financial exposure of our assets to climate-related risks across three different scenarios (SSP1-2.6, SSP2-4.5, and SSP5-8.5) and timeframes (2030, 2050, and 2100). The VaR has been calculated for each type of physical risk, excluding wildfire and drought stress, which were considered non-material. The results indicate a minimal and immaterial financial impact projection, concluding that no property is currently considered financially material under these physical climate risks.

Apart from the direct impacts of physical climate risks, we have also evaluated the indirect effects. The most significant risks identified are rising insurance rates and capitalisation rates. Based on the results from financial tests conducted, it is observed that property owners may experience an increase in insurance premiums due to an unexpected coastal flooding event. Another risk identified is the increase in capitalisation rate due to moderate and severe coastal flooding events. However, the overall VaR remains immaterial for our portfolio throughout the analysis.

Transition Risks & Opportunities Assessment

Transition risks and opportunities were identified by supplementing the latest literature and data to provide both qualitative narratives and quantitative modelling for the transition risk scenario analysis.

|

Risks |

Potential Impacts |

Risk Mitigation |

|

Policy & Legal |

|

|

|

Technology |

|

|

|

Market |

|

|

|

Reputation |

|

|

Risks

Potential Impacts

- Strengthened regulations, building codes and standards on building energy efficiency

- Hong Kong's plan to establish a carbon pricing scheme and the launch of the trial carbon trading market in China

- Additional operating cost for greenhouse gas ("GHG") emissions

Risk Mitigation

- Conduct building energy audits to ensure compliance

- Develop internal future-proof targets to prepare ahead for the regulatory transition to more stringent building codes

- Review material sources of carbon exposure from time to time and estimate the financial impact on the Group's operations

Potential Impacts

- Emerging technologies in building construction and property management

Risk Mitigation

- Invest in green technology and commercially viable alternative construction materials

- Leverage partnerships with different stakeholders to drive innovative solutions for sustainable development

- Proactively support tech ventures to translate research outcomes into real-world solutions to foster the Group's climate and energy transition capabilities

Potential Impacts

- Growing expectations from customers for green and energy-efficient properties

Risk Mitigation

- Integrate sustainability, technology and innovation into our building design and daily operation

- Develop internal future-proof targets to meet consumer demand for green building space further

Potential Impacts

- Higher expectations from customers and more stringent climate disclosure requirements from financiers, impacting how the company manages and discloses its climate risk and opportunities

Risk Mitigation

- Enhance sustainability disclosure and continue to disclose our ESG-related information annually

- Continue to conduct climate risk assessment, disclose potential climate risks, and enhance the breadth and depth of the disclosure

- Strengthen engagement efforts with tenants and relevant stakeholders in climate resilience and sustainability

|

Opportunities |

Potential Impacts |

Opportunity Management |

|

Digitalisation & Proptech |

|

|

|

Consumer Preference |

|

|

|

Renewable Energy Growth |

|

|

|

Green Finance |

|

|

Opportunities

Potential Impacts

- Implementation of new technologies in building construction and property management to address the climate transition needs, such as the use of smart technologies to enhance energy saving

Opportunity Management

- Conduct feasibility studies and integrate sustainability, technology and innovation into our building design and daily operation

- Adopt research and development ("R&D") on smart technology adoption in buildings

- Develop smart apps and consumer engagement technology for low-carbon living

- For more information, please refer to the "Embracing Innovation and Sustainable Construction" section of this Report

Potential Impacts

- Growing expectations from customers for green and energy-efficient properties, which will require innovations, strategies, and systems to compete for higher rents and valuations

- Decreased asset valuation of properties with high climate exposure

Opportunity Management

- Integrate sustainability, technology and innovation into our building design and daily operation

- Set targets for obtaining green building certifications. Currently, the Group aims to attain the 2nd-highest rating of BEAM Plus for 100% new major projects, and target the 2nd-highest rating for LEED and WELL

- For more information, please refer to the "Green and Innovative Building" and "Carbon Footprint Management" sections of this Report

Potential Impacts

- Adoption of renewable design and renewable resources as a way to decarbonise buildings, such as the use of solar panels and renewable energy

Opportunity Management

- Conduct feasibility studies to expand renewable energy use and green technology adoption

- Consider renewable energy as a building option

Potential Impacts

- Increasing trend of green and sustainable finance, allowing businesses to access lower-cost capital, which capitalises investment in green and climate-resilient projects and R&D

Opportunity Management

- Continue to invest more in low-carbon projects and the enhancement of sustainability performance, and obtain funding

- Consider enhancing disclosure of the use of proceeds and progress achieved by projects funded by existing green loans to demonstrate credibility

- For more information, please refer to the "Sustainable Financing and Responsible Investment" section of this Report

Financial Impact Assessment of Transition Risks

To assess the key impacts and financial implications of the Group’s identified transition risks and opportunities, we have mapped relevant financial impact parameters to these risks and opportunities and conducted scenario analysis. The profit and loss implications are quantified and expressed as percentage changes in carbon and energy costs, providing a clearer view of potential financial exposure.

- Under the Net Zero 2050 scenario, we anticipate a significant rise in carbon tax beginning in the 2030s and extending from the 2100s onwards. The reduction in electricity costs is expected to begin in the 2050s and extend beyond the 2100s.

- Under the Current Policies scenario, the notable increase in carbon tax is expected to start from the 2050s onward. A substantial reduction in electricity costs will likely occur from the 2030s, with further reductions expected from the 2100s onwards.

Risk Management on Climate-related Issues

Our Group has adopted an approach to ensure accurate identification of climate risks and opportunities based on the latest scientific research, and we are making significant progress towards achieving our climate goals. We have identified, assessed and addressed the potential impacts of climate-related risks and opportunities in our operations, supply chain and business model. These risks have been integrated into the Group’s Enterprise Risk Management (“ERM”) framework.

Looking forward, we are working to prioritise and implement a monitoring mechanism to enhance our management of climate-related risks and capitalisation of climate-related opportunities in the future.

Metrics & Targets on Climate-related Issues

CCG identifies carbon emissions as material metrics to monitor climate risks. We also develop ambitious climate-related targets – CCG 3050+ – that align with the goals of the Paris Agreement to help limit the global temperature increase to 1.5˚C above pre-industrial levels.

In January 2022, the Group received validation from the SBTi that the Group’s CCG 3050+ fulfills the conditions for limiting global warming to 1.5˚C. These approved SBTs are:

51.8%

Reduction in operational carbon intensity (Scope 1 and 2) in 2030 compared to the 2020 base year

20%

Reduction in Scope 3 carbon intensity from capital goods, downstream leased assets and waste generated in operations, in 2030 compared to the 2020 base year

We are en route to lowering our operational carbon intensity under Scope 1 and 2 by 51.8% by 2030 compared to the 2020 base year.

To understand how the Group is committed to lowering Scope 3 carbon emissions, particularly on our embodied carbon from capital goods, please refer to the “Demonstrating Green Building Leadership” section of this Report.

2024 Progress of Our CCG 3050+ Carbon Reduction Target

2024

-27.7%

Carbon Intensity (Scope 1 and 2)

2030

-51.8%

Carbon Intensity (Scope 1 and 2)

Our Achievements:

- Enhanced existing assets to reduce operational carbon, for example, the chiller plant replacement project at Nina Tower and Nina Hotel Kowloon East

- Developed our ESG Due Diligence Checklist for M&A in which a threshold for carbon intensity is set for asset acquisition. Resources for upgrading energy efficiency should be earmarked for assets that do not meet the threshold

- Invested in energy efficient buildings, such as D·PARK

- Engaged our staff to integrate the concept of decarbonisation into daily operations

Future Plan:

- Actively pursue asset enhancement opportunities for decarbonisation, of which we have planned a range of projects, resulting in approximately 86,000 MWh of energy saving till 2030, equivalent to the annual emissions of around 4,700 standard households in Hong Kong

- Design and construct buildings with high sustainability standard by adhering to the Sustainable Design and Procurement Manual

- Continue to uphold the principles of ESG Due Diligence Checklist in asset acquisition

- Leverage advanced technologies, such as AI and digital twin, to optimise building energy performance

Policy & Legal

Policy & Legal Technology

Technology Market

Market Reputation

Reputation Digitalisation & Proptech

Digitalisation & Proptech Consumer Preference

Consumer Preference Renewable Energy Growth

Renewable Energy Growth Green Finance

Green Finance